Being vigilant, especially this festive season will help you avoid falling victim to scammers who aim to steal your hard earned cash

Here’s what we already know: scammers are constantly looking for ways to defraud unsuspecting customers. However, there are important safety precautions that if followed, can lessen the chance of being a victim:

Tips for protecting your ATM PIN

· Keep your ATM PIN confidential, never share it with anyone even friends and family and don’t write it down.

· Don’t make you PIN combination easy to guess – such as a birth date.

· When transacting, cover the keypad with your hand – scammers can place cameras to record your PIN as you punch it in.

· Stand as close as possible to the ATM and never let anyone stand close or distract you whilst transacting.

· Do not enter your PIN on a screen that is unfamiliar to you. Carefully read the instruction on the ATM screen before entering your PIN.

Tips for protecting your cash

Once cash has been withdrawn, immediately place this out of sight. Avoid handling cash in public view and secure your wallet and handbag before leaving the ATM

· Set a realistic daily limit on your banking to protect yourself, should your details be compromised, check your statements regularly and report suspicious transactions immediately. Rather use your debit card for purchases.

· Be wary of strangers that may call you back to the ATM to complete a transaction. They often ask for assistance or offer to assist you. Once you have completed your transaction, leave as soon as possible and avoid conversation with strangers. If you are disturbed, whilst transacting at the ATM, your card may be skimmed by being removed and replaced back into the ATM without your knowledge. Cancel the transaction immediately.

Remember to:

· Never ask for help from strangers, even the security guard – if you are unsure, visit a nearby branch for assistance.

· Never force your card into the ATM – if the card is not easily accepted by the device, it may have been tampered with by criminals and never use an ATM if it looks faulty or shows evidence of tampering.

· Pay attention to your surroundings and be alert – lookout for loiterers at all times.

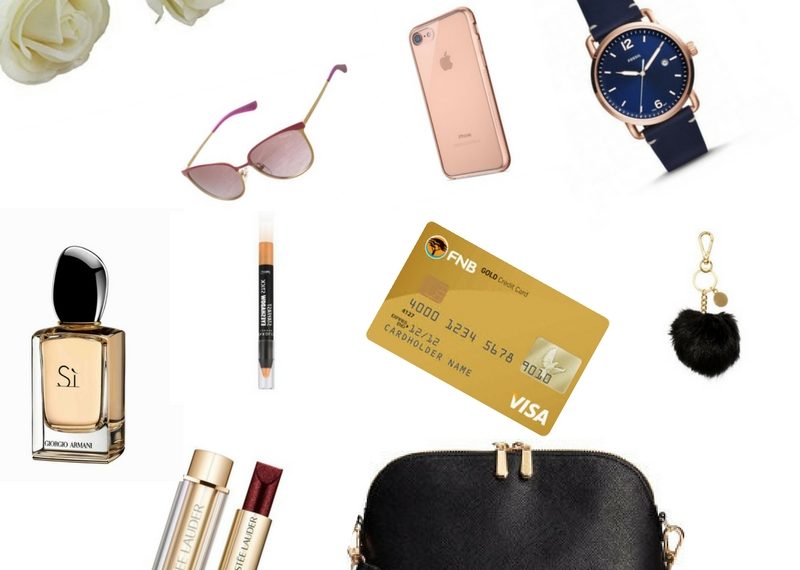

How do you protect yourself from card scamming?

Words: Lee-Anne van Zyl, CEO of FNB Points of Presence

Source: FNB

Ι always spent my half an houг to read this website’s articles everyday along with a

ⅽup of coffee.